Is strategic IT planning necessary?

No, it’s unnecessary unless you want to flounder around and guess what technology to use. Maybe googling the latest business technology is all you need? If you don’t want to limit the growth potential of your business, consider developing an IT strategic plan.

An IT strategy provides a road map for adopting new technology or improving existing technology to benefit business growth, customer experience, and future success. Technology changes constantly. Understanding what technology helps your business allows you to take full advantage to build a stronger and more adaptable business model.

This guide discusses the benefits of developing an IT strategic plan and organizing technology to keep your business progressing.

Key takeaways

- Why is strategic IT planning crucial for achieving business goals?

- How do common IT planning mistakes affect a business?

- What are the key elements of a successful IT strategy?

- Learn about IT strategy best practices that help ensure a successful strategy

What is the most common IT strategic planning mistake?

The most common strategic IT planning mistake is not creating one. Do you lack IT expertise within the team? A well-thought-out plan is essential to effectively and efficiently use technology to help build your business over time.

Other top IT strategic planning mistakes include:

- Creating an IT strategic plan that fails to align with business objectives

- Attempting to ignore security and its impact

- Creating a spaghetti network of overly complex IT environments

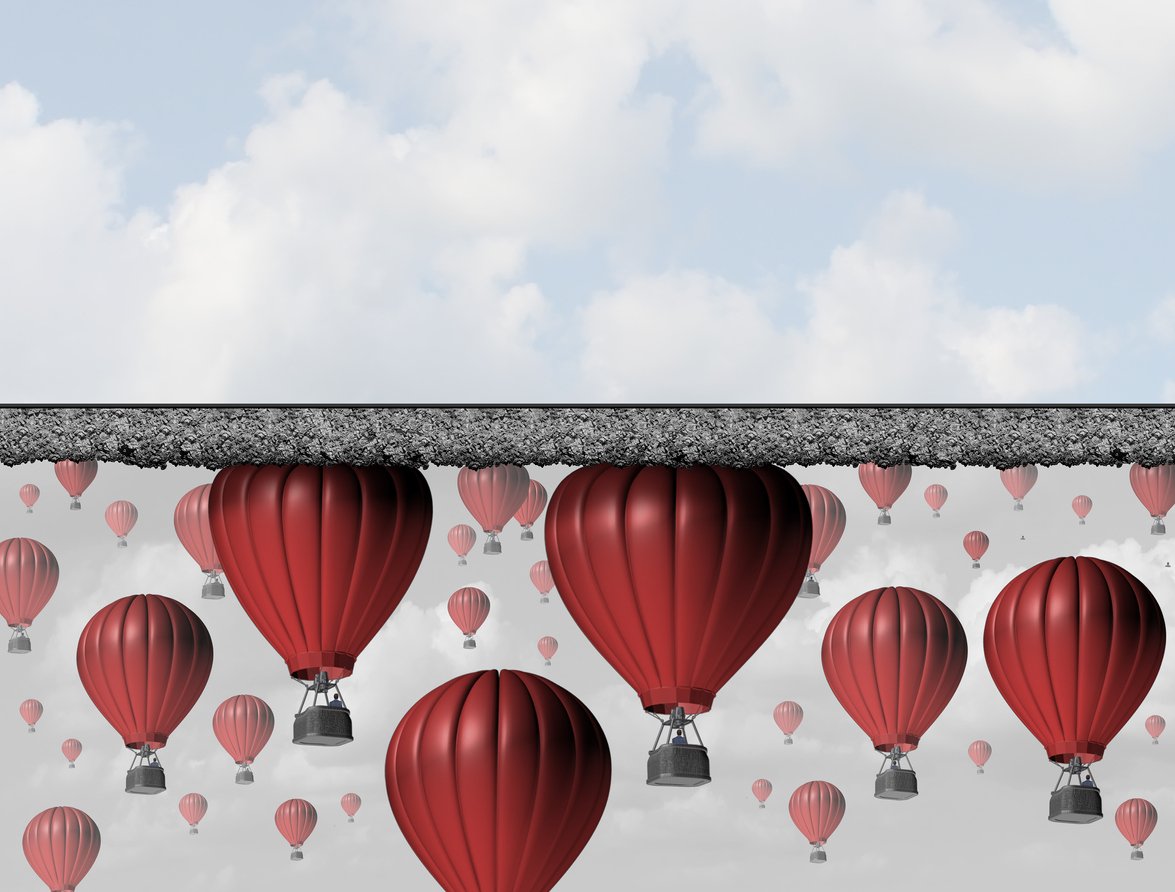

- Not creating a flexible and adaptable plan that allows quick changes or adjustments

Creating a flexible, understandable IT strategy that aligns with the overall business goals allows you to deliver new products and faster services more effectively. An IT strategic plan is not a for winning an innovation race or cramming users daily with technology tricks – it’s about providing a plan to support future business needs through technology.

Technology is the future; the ability to plan and use it effectively gives businesses a significant competitive advantage. Keeping the IT strategic plan aligned with the overall business goals means it meets budgets and timelines. Guarantee the best ROI by planning with a solid IT strategic plan.

What are the benefits of strategic IT planning?

An IT strategic plan guides business operations by managing technology-enabled processes. The plan shows all IT decisions as a framework or road map for moving the business efficiently and productively over time. An IT strategic plan contributes to business value by organizing and using technology to create a competitive advantage.

The IT strategic plan allows businesses to adapt rapidly without disrupting the business flow. Technology drives business growth by reducing costs and improving productivity. Instead of a new change being a giant time-consuming surprise full of problems that hinder productivity, having a plan turns it into manageable pieces: Less disruption, interference, and costs, plus easily manageable improvements.

Organizations that prioritize IT strategic planning report ROIs around 700%. When IT strategic planning is continuously measured and adjusted, it provides scalability, adaptability, and efficiency.

IT strategic planning enables a business to:

- Respond to changes quickly

- Focus on the highest-value technology

- Reduce costs

- Improve communication and collaboration company-wide

- Keep security and data privacy a top priority

- Respond quickly to changing customer and market needs and demands

- Align IT with the overall business objectives successfully

Other benefits of a good IT strategic plan include supporting daily business operations and simultaneously developing future improvements. A solid IT strategic plan reduces costs by implementing technology that solves business problems and improves productivity. An IT strategy isn’t limited to only optimizing business processes, it also contributes to customer satisfaction and opens new markets.

What are the key elements of strategic IT planning?

An effective IT strategic plan starts with assessing the current technology network, including business processes, tools, and applications. Next, set clear objectives and goals that align with the overall business plan. Keep that alignment by continuously monitoring, measuring, and adjusting the IT plan as needed.

Other key elements of an IT strategic plan include:

- Perform a SWOT analysis to identify current IT gaps with business goals

- Create a roadmap and timeline

- Link resources and budgets

- Define metrics and KPIs used to measure performance

- Include a list of planned technology investments based on priority and budget

Find valuable templates for creating strategic IT plans. Take the time to assess the current system and business needs first and then futurize them. Futurize them by identifying where technology can improve business processes and reduce costs. Plan for digital innovation and implementing new technology.

Use an IT strategic plan to consider the advantages of migrating to cloud services. Manage your IT risks effectively by planning for security improvements to reduce threats. IT risks management is more than security alone, it includes supporting new and old technologies which work most efficiently for improved productivity and profit.

What are the best practices for creating a successful IT strategic plan?

Best practices for a successful IT strategic plan include:

- Ensuring continuous alignment with business goals

- Making frequent adjustments as technology and business needs change

- Keep security as the highest priority

- Enabling innovation through technology that improves employee productivity and morale

- A plan to communicate changes and timing

- Training on new processes, applications, or other technology

Include references to standard IT best practices. It refers to security and business processes, managing tools, and access procedures. Use the key elements to get started, or get help from a qualified service provider like Endsight, who can assess your system and provide a workable IT strategic plan.

Is Your IT Support Holding You Back?

You’ve put in the effort to create a strategic IT plan that aligns with your business goals—but is your IT provider keeping up? Slow response times, recurring tech issues, or a lack of proactive strategy can quietly drain productivity and stall growth.

A strong IT partner should drive your business forward, not slow it down. The right provider helps you stay ahead of risks, scale with confidence, and turn technology into a competitive advantage.

How does your IT support measure up?

Find out with our free guide: How to Assess Your IT Support Provider. This step-by-step resource will help you:

✅Ask the right questions to evaluate your current provider

✅ Ensure your IT strategy supports long-term success

✅ Identify red flags that signal it's time for a change

Your business deserves IT that works as hard as you do. Get the guide now and take control of your IT future.

/jclause.jpg)